Amazon is clearing out a 10,000mAh portable charger with integrated charging cables and, according to a Gizmodo report, stock is flying off virtual shelves. The deal highlights both simple consumer demand for convenience and larger trends reshaping battery retail: tighter competition, AI-driven pricing, supply-chain adjustments and growing attention to where the materials come from.

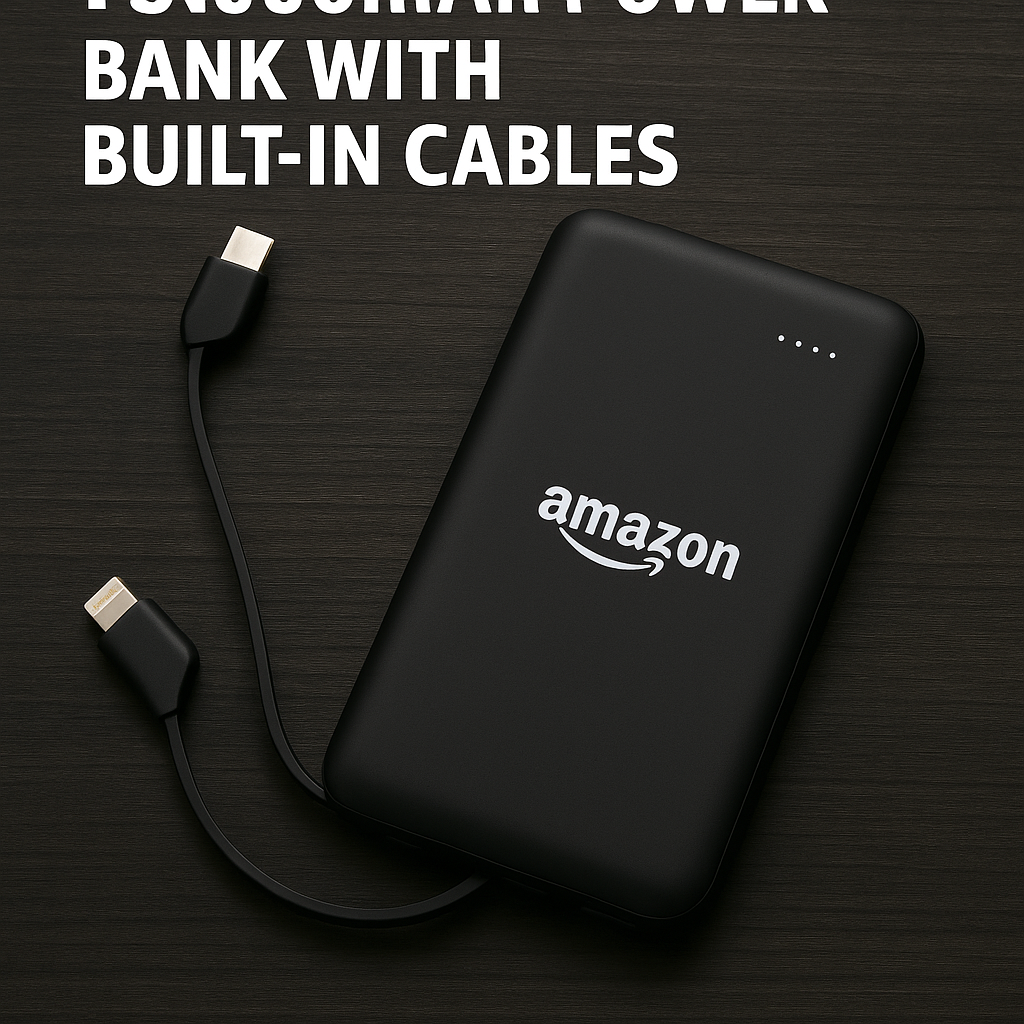

The advertised 10,000mAh capacity is a useful mid-size power bank for daily carry: at a nominal cell voltage of 3.7V, that works out to roughly 37Wh, well below the 100Wh airline limit for carry-on batteries. Built-in cables — typically combinations of USB-C, Lightning or Micro-USB depending on the model — eliminate the “where’s my cable?” friction that many users complain about. Models in this category often support USB Power Delivery or Qualcomm Quick Charge for faster recharge cycles, but buyers should always confirm supported protocols and output wattage before purchase.

Why is this clearance selling so fast? Multiple factors converge. First, the product fits a clear consumer need: smartphone and accessory battery life struggles continue to drive demand for compact, reliable power banks. Second, price-sensitive shoppers respond strongly to limited-time discounts on familiar platforms like Amazon. Third, algorithmic repricing and inventory management — powered increasingly by AI — help retailers identify overstock and trigger aggressive markdowns in real time. That AI-driven optimization can result in sudden surges of clearance listings that move quickly when they match consumer search patterns.

Retail-level shifts like this also ripple into startup and manufacturing ecosystems. Direct-to-consumer brands and small hardware startups compete on features (integrated cables, ruggedness, wireless charging) and margins. Rapid clearances from major online marketplaces can compress prices and squeeze margins for newer entrants, complicating fundraising conversations and go-to-market strategies. At the same time, investors continue to channel capital into battery chemistry, recycling and fast-charging startups as electrification remains a priority across industries.

Geopolitics and supply chains form the broader backdrop. The global battery supply chain is heavily concentrated in Asia, particularly China, for both raw material processing and cell manufacturing. Policy moves such as the US Inflation Reduction Act and European industrial strategies aim to expand domestic battery capacity and reduce dependency — attracting funding into local manufacturing and recycling. Blockchain technologies are also being explored by startups and OEMs to provide tamper-evident provenance for battery materials, enabling claims about ethical sourcing of lithium, cobalt and other inputs to be independently verified.

There are safety and regulatory dimensions as well. Power banks must comply with transport and safety standards; buyers should look for UL certification or equivalent safety marks. Since airlines cap batteries at 100Wh for carry-on, this 10,000mAh runner is typically compliant, but consumers who own multiple banks or high-capacity models should check airline policies before travel.

For consumers, the immediate takeaway is simple: if you need portability and convenience, an integrated-cable 10,000mAh bank on clearance can be a high-value purchase — provided you verify compatibility, output specs and safety certifications. For startups and incumbents, the clearance event is a reminder that pricing pressure, accelerated by AI-driven retail tools and shifting inventory dynamics, can rapidly change competitive landscapes.

As demand for mobile power continues alongside electrification trends, expect more flash clearances and promotional cycles. Those moves will be shaped not only by consumer behavior and AI pricing engines but also by deeper changes in funding flows, supply-chain geopolitics and technologies like blockchain that aim to increase transparency in where our batteries — and the minerals inside them — actually come from.