Green shift: who, what, when, where and why

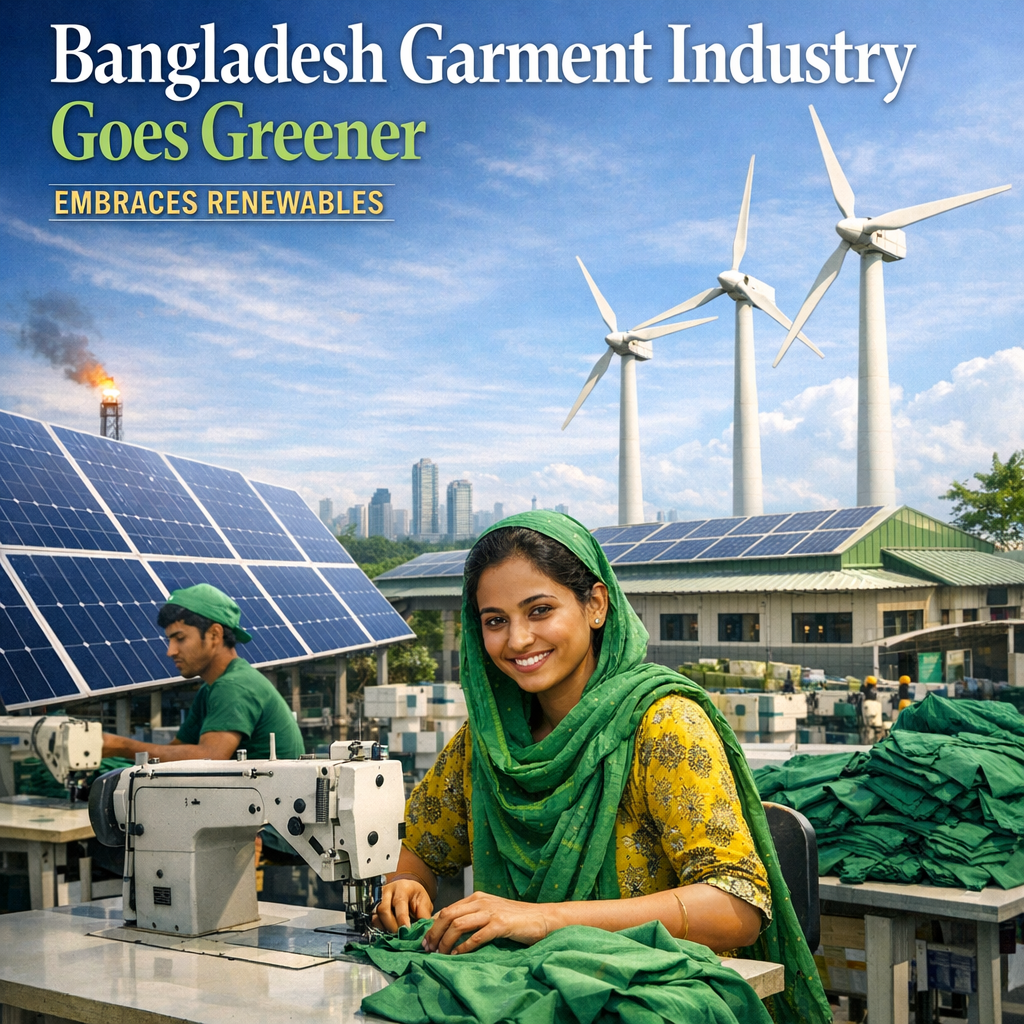

Dhaka — Bangladesh’s ready-made garment (RMG) sector, which accounts for roughly 84% of the country’s exports and employs about 4 million people, is accelerating a shift toward greener production. Since the Rana Plaza collapse in April 2013 prompted international scrutiny of factory safety, sustainability has moved from reputational add-on to commercial imperative. In the past five years especially, exporters and global buyers have stepped up investments in rooftop solar, effluent treatment plants (ETPs), energy-efficiency upgrades and chemical-management systems to cut costs, meet compliance and respond to customer demands.

What changes are factories making?

Manufacturers are implementing a range of interventions across energy, water and chemicals. Rooftop solar arrays and captive renewable installations are becoming common on large facilities; combined heat and power (CHP) and waste-heat recovery are used to reduce fuel consumption; and many dyeing and finishing units are installing modern ETPs and moving toward closed-loop water systems to reduce freshwater use and pollution.

On chemicals and inputs, brands and suppliers increasingly follow industry schemes such as Zero Discharge of Hazardous Chemicals (ZDHC), the Global Organic Textile Standard (GOTS) and the Better Cotton Initiative (BCI). These programs require stricter chemical inventories, controlled discharge parameters and certified raw-material sourcing. Buyers including H&M, Inditex (Zara), Primark and Levi Strauss have publicly set targets for cleaner supply chains and are pressuring suppliers to demonstrate compliance.

Financing and industrial policy

Financing has been a catalyst. Local banks have rolled out green loans for energy-efficiency projects, and multilateral finance institutions have offered lines of credit and technical assistance for wastewater treatment and cleaner technologies. Large Bangladeshi groups such as DBL Group and Beximco have publicly invested in energy and water infrastructure at scale, while smaller suppliers often rely on buyer-led financing, factory savings from reduced utility bills, or concessional finance to cover upfront costs.

Background and industry context

Bangladesh rose to global prominence as a low-cost apparel hub in the 1990s and 2000s, building a highly export-oriented textile ecosystem of knitwear and woven garments. Quality, price and speed to market have long driven buyer decisions; sustainability has become a fourth pillar. Regulatory pressure and buyer codes of conduct — intensified after 2013 — combined with evolving global rules such as the EU Green Deal and the proposed Carbon Border Adjustment Mechanism (CBAM) are nudging exporters to decarbonize operations to retain market access.

Technological change is also reshaping the cost calculus. Modern dyeing machines, low-liquor ratio washers, enzymatic chemistry and real-time process controls reduce water, energy and chemical use. Adoption rates vary: tier-1 factories serving premium brand contracts are often quickest to upgrade, while small- and medium-sized suppliers face financing and technical barriers.

Expert perspectives and industry insights

Industry observers say the shift is pragmatic as much as ethical. Analysts note that energy and water savings translate into margin improvements — a compelling business case for investment. Compliance with ZDHC and third-party audits has become part of due diligence for major retailers. At the same time, sustainability specialists caution that change must be systemic: isolated investments in solar or an ETP are insufficient without improved process controls, trained personnel and transparent monitoring.

Buyers emphasize traceability and remediation. Retail sourcing teams increasingly require supplier-level environmental management systems and independent verification. Development partners and donor agencies continue to push capacity-building programs aimed at smaller factories to broaden the impact.

Implications and outlook

For Bangladesh, greener garment manufacturing offers multiple benefits: lower operating costs, reduced regulatory risk in key markets, and improved resilience to energy-price shocks. However, challenges remain. Upfront capital, uneven enforcement of environmental standards, and the need to protect worker livelihoods during transition are persistent issues. Policymakers and industry groups will need to align incentives, expand access to green finance and prioritize technical assistance.

Looking forward, the industry’s trajectory will be shaped by buyer requirements, global trade rules such as CBAM, and the availability of affordable finance and technology. If investments continue and capacity builds across the supplier base, Bangladesh can strengthen its competitive edge by pairing low-cost manufacturing with lower-carbon, cleaner processes — a combination likely to matter increasingly to global apparel supply chains.